Chapter 20 Why Subjective Information Matters

Traditional economic indicators primarily focus on objective information, such as the quantity of goods produced in an economy. However, subjective factors, like beliefs and expectations, also play a crucial role in shaping the economy. Unlike some processes in physics, the economy is not driven solely by external factors. Instead, it involves decisions made by individuals, businesses, and policymakers based on their perceptions of the future. Consequently, the trajectory of an economy is influenced not only by its past but also by what people anticipate in the future.

Moreover, people’s anticipations are not solely based on objective information; they are also influenced by subjective information, which can sometimes lead to mistakes with real implications. This chapter delves into the significance of such subjective information in economic analysis and decision-making, shedding light on how beliefs can have a tangible impact on the overall economy.

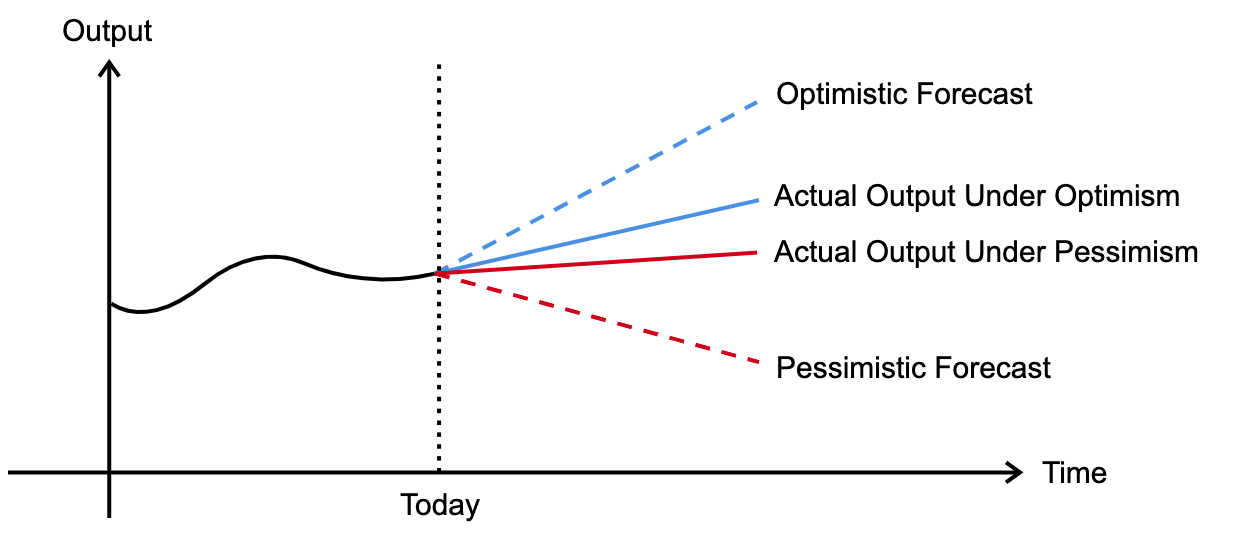

Figure 20.1: Beliefs and their Impact on the Economy

The diagram in Figure 20.1 illustrates how beliefs can affect the economy. When individuals and firms hold optimistic expectations, anticipating a significant rise in output or economic prosperity, they tend to adjust their behavior accordingly. This optimistic outlook leads to increased spending, heightened investment, and expanded production to cater to the expected high demand in the future.

Conversely, when people and firms become overly pessimistic about the economic prospects, they tend to reduce their spending and investment, anticipating a decline in demand or adverse economic conditions. Consequently, this pessimistic sentiment results in lower actual output than would be the case if optimism prevailed.

The significance of subjective information lies in its forward-looking nature. Economic decisions are rarely made based solely on historical data and past performances. Instead, they are heavily influenced by people’s perceptions of what lies ahead. The forward-looking aspect arises from the inherent time lags in various economic processes.

For firms, the decision-making process involves planning and production, often taking months or even years before the final product reaches the market. Consequently, they must make choices based on their beliefs about future demand, market conditions, and overall economic stability.

Similarly, households’ decisions are also forward-looking, particularly when it comes to long-term investments. For instance, investing in education involves anticipating future career prospects and employment opportunities. Likewise, purchasing a house entails evaluating the capacity to pay the mortgage in the future. Therefore, households make decisions today based on their beliefs about the future economic situation.

Even policy makers are not immune to the influence of subjective information. When formulating policies to improve the economy, they must take into account the expectations and beliefs of various economic actors. Moreover, the impact of policy changes is often delayed, as it takes time for these changes to be fully transmitted and realized within the economy. For instance, a change in the policy rate may take months to influence overall inflation and other economic indicators.

The interplay between beliefs and economic decisions creates a feedback loop that can amplify economic fluctuations. Optimistic beliefs can fuel economic expansions, while pessimistic beliefs can exacerbate downturns. This dynamic relationship underscores the significance of understanding and incorporating subjective information into economic analyses.

In summary, beliefs and expectations play a crucial role in shaping economic outcomes. Subjective information influences economic decision making, leading to real-world consequences that impact production, consumption, investment, and overall economic growth. Acknowledging the significance of subjective information allows economists and policymakers to gain deeper insights into the mechanisms that drive economic fluctuations and to formulate more effective strategies for managing economic stability and growth.

In the upcoming chapters, we will delve into datasets that capture subjective information, including survey data, forecaster data, real-time data, and textual information like newspapers and social media posts. We will learn how to utilize this subjective information to construct economic indicators such as consumer confidence indices, forecast disagreement indices, and text-based uncertainty indices. Embracing the subjectivity of economic decision-making will enable us to gain a more comprehensive understanding of the economy and enhance our forecasting capabilities.